19 Amazing Tax Deductions For California Small Businesses

California small business taxes can top 53%. Here are 19 valuable tax deductions for the self-employed and small business owners.

We’ve all heard it’s not what you make but what you keep. Minimizing your Tax bill is a great way to shore up your financial future. In this section of the best Financial Planner LA blog, we will share Los Angeles tax planning tips and cover other tax topics.

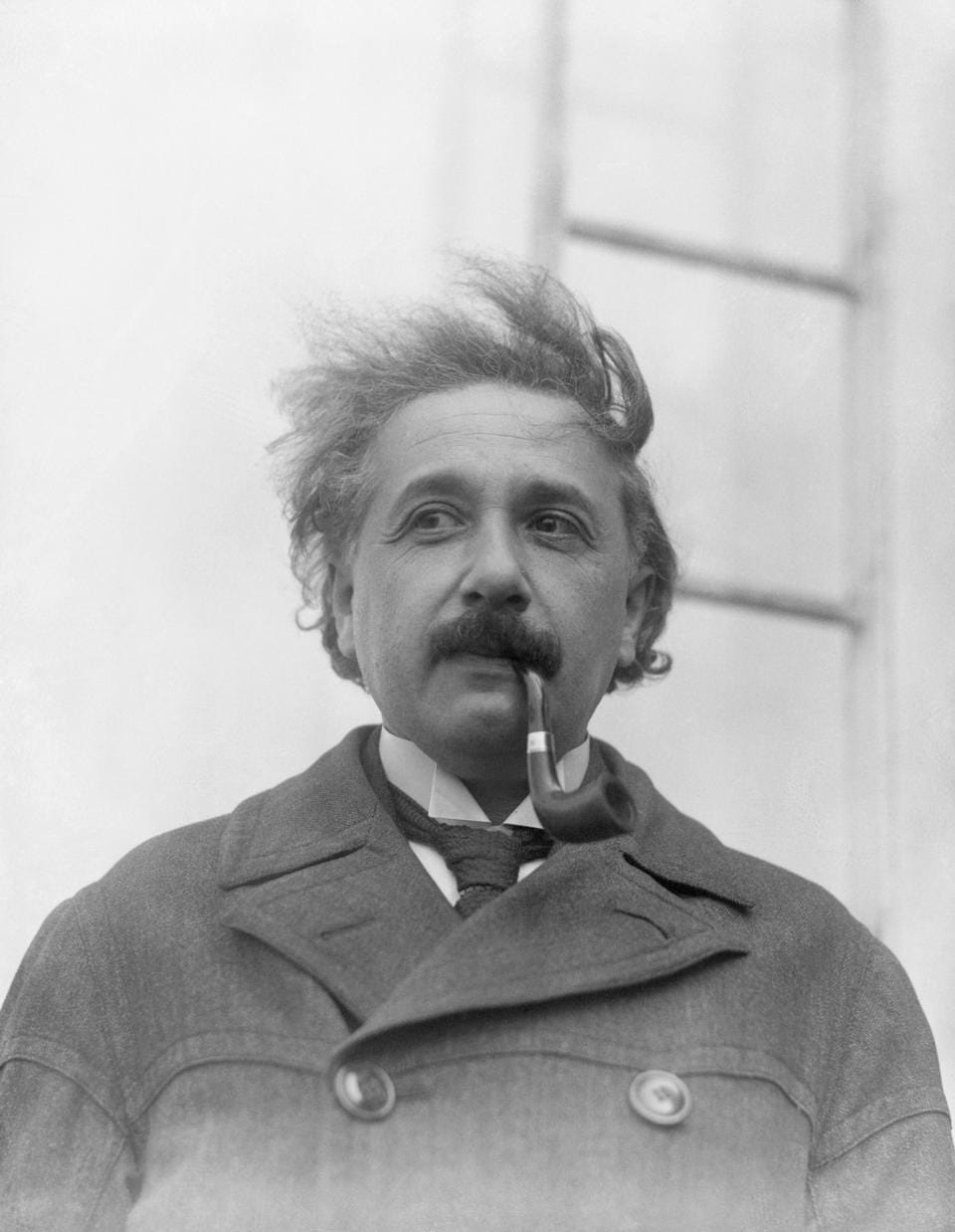

Does even thinking about taxes make you want to scream? Taxes don’t have to be so stressful. Los Angeles Financial Planner David Rae can help you take the stress of tax planning off your plate.

How to simplify your financial life? One way is to simplify your taxes and make some easy tax planning choices to keep more of your hard-earned money.

You will see blog posts and videos from National Shows like Nightline, E! News, The Today Show, NBC Nightly News to local News from KTLA, CBS, NBC, Fox 11 and ABC 7 eyewitness news.

You can improve your finances, and achieve financial freedom. We are here to help.

Live for Today, Plan for Tomorrow. Taxes will be due sooner than you think.

California small business taxes can top 53%. Here are 19 valuable tax deductions for the self-employed and small business owners.

Does your Los Angeles Financial Advisor offer tax planning guidance? They may no even be allowed to offer tax saving tips. What you need to know to get the best tax advice.

California has some of the highest taxes in the country. Most people have no idea how california taxes capital gains. What you need to know about your investment taxes in CA.

How to get the most tax benefits from a Roth Solo 401(k) for your small business. Who doesn’t love tax free income.

It isn’t how much you make but how much you keep. How the Solo 401(k) can help business owners slash their tax bills in 2021.

Looking for more tax deductions to help your business pay fewer taxes? A Cash Balance Pension Plan may be the keep to keeping more of your hard earned money.

You need to know the SEP IRA contribution limits to make sure you can minimize the taxes on your small business income.

Financial Planner LA offers tax planning guidance for common tax season questions and tax law changes from the TCJA.

The Defined Benefit Pension plan is a great way to lower you taxes if you make $500,000 or more per year. The tax planning financial advisor shares what you need to know abou this valuable tax planning strategy.

Should Cash Value Life Insurance be part of your retirement income plan? Financial Planner LA explains what you need to know.

The Biggest Mistake You Are Making with your 401(k)k could cost you over a million dollars. For some of you, it could lower your 401(k) balances by several million dollars. We are facing a retirement planning crisis in America. Boomers, …

Which is the Best ROTH IRA or ROTH 401k? Should I be putting more money towards my Roth IRA or Roth 401(k)? The good news is more employers are offering a ROTH 401(K) as part of their retirement plans. The …

Financial Advisor LA appears on the NBC with your Powerball Winning Guide. How to keep more of your winnings and minimize taxes.

Are you coming into a big chunk of money? What to do if you get an inheritance, win the lottery or even get a nice bonus.

California is known for being a high tax state. Will your inheritance get with an Estate Tax by California? Financial Planner LA answer your questions.

Los Angeles has just implemented a new tax on some residents when they sell their homes. This new transfer tax is in addition to plain old property taxes and capital gains taxes you will owe on the appreciation of your home when …

To make the best investing choices you need to know about the taxes you will owe when your investments go up. Financial Planner LA outlines the capital gains taxes on investment gains.

4 tax planning strategies you need to implement now for your small business

4 Valuable Tax Planning Strategies Gay Couples Need To Utilize For 2023 Tax Season. Two of my good friends just got gay married (or, as we call it in real life, “Married”), and of course, they asked me what this …

How the rich use the Buy Borrow Die Strategy to avoid paying taxes. You can use the tax planning tip to avoid capital gains taxes on your investments.

© 2024 Financial Planner Los Angeles

This site has been published for residents of California (Insurance License # OE10562), Arizona, Ohio, Florida, and Colorado. All information herein has been prepared solely for informational purposes, and it is not an offer to buy or sell, or a solicitation of an offer to buy or sell any security investment or instrument or to participate in any particular trading strategy. Securities and investment advisory services offered through DRM Wealth Management LLC a Registered Investment Adviser. The videos, articles and other content maintained on this site as well as the opinions voiced in this material are resources for educational and general informational purposes only and are not intended to provide specific advice or recommendations for any individual. No information on this site constitutes financial advice and should not take the place of consulting with a certified financial planner and tax, legal or other financial advisor. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing.