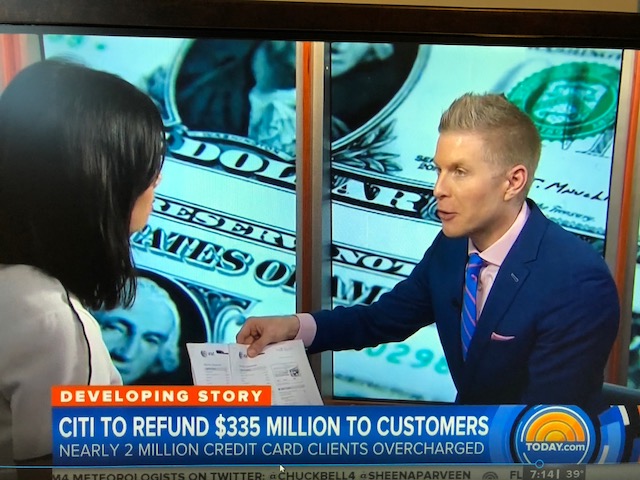

Citi Bank will be returning $330 million to 1.75 million of its customers. This breaks down to an average refund of around $190 per customer. Jo Ling Kent interviews financial planner David Rae on the Today Show discussing how to know if you are being overcharged. Also using this opportunity to review your bills and see where you can save money without having to cut back. Today show financial expert David Rae video- watch here.

This week, The Today Show invited me to discuss how people might have been able to spot being overcharged by Citibank. The reality is even the most financially savvy people would most likely never know they were being overcharged by their banks. Why? The reason is that we are often talking fractions of a percent that is spread over a year. That might not seem like much but those pennies can really add up. In the case of Citibank, it will be refunding $330 million to more than 1.75 million customers.

Use this as an opportunity to review your bills, and see where you can pay less for your current services like cable, cell phone, and Internet. By doing so, you may find that you are potentially able to save thousands of dollars, per year, without having to cut back. Might as well live your best life.

By David Rae Certified Financial Planner™, Accredited Investment Fiduciary™

We all would love to have more money, am I right? The best way I’ve found to do this is to pay less for the things we already buy. In other words, stop overpaying day-to-day expenses. Here are a few tips that could save you a few thousand bucks over the next year without forcing you to make cuts. Smart spending will mean more money for fun things like travel or even saving for retirement.

Save money on cable:

I bet a bunch of you are paying for cable boxes that you aren’t using? If so, send them back. Also, look at all the stations you are paying for each month. Do you even watch half of them? If not, see if you can change to a more efficient channel package or just call and ask for a discount. The last time I called, I got $100 taken off my bill, each month, for a year. That is $1,200 extra in my pocket without cutting back at all.

Also from NBC News:

Will the GOP Kill the 401(k) Tax Deduction – Video Featuring David Rae

Save money on newspapers:

I have three newspaper subscriptions. Yes, I still read an actual newspaper with my morning coffee. I called each publication and got something between 50 and 75% off the next year’s subscription. If I had to pay full price, I would have canceled one or two of them but because I called, I wound up saving almost $900 for the year. Of course, I would save even more if I read them online but I enjoy reading a printed newspaper. In case anyone cares I read the LA Times, NY Times and Wall Street Journal.

Save money on Internet:

I saw an advertisement for Internet service that was way cheaper than what I was paying. After a quick, 10-minute call to my provider, they put me on a retention special and gave me a better-discounted rate.

My bill was reduced $30 per month for the next year which made my total savings for the year $360!

Save on auto and home insurance:

More than saving money, I wanted to make my bookkeeping easier. By switching from a monthly to a six-month billing cycle, I save $3.00 per month. Thirty-six dollars per year isn’t really a big deal, but it does simplify tracking where my money is spent.

On a side note, I also raised my deductibles. A $500 higher deductible saves me around $400 per year on each policy. If I can go 15 months without an accident, I’m ahead. Here’s hoping for no accidents either way. Living in LA, there are lots of dings and fender benders. How much damage can you do at 2 mph? You might be amazed.

Tallying up my savings in these four areas, you’ll see that my grand total savings come to about $3,300 per year. And all I had to do was spend less than an hour on the phone. I have no doubt frugal living experts could wrangle a few more dollars of savings. What could you do with an extra $3,300 per year?

You don’t have to be a financial expert to look for places where you can save more of your hard-earned money without having to cut back. I spent an hour on the phone, searched on Google and ended up saving enough money to pay for my next vacation. Win Win Win.

Live for today, plan for tomorrow.

DAVID RAE, CFP®, AIF® is a Los Angeles financial planner with DRM Wealth Management. A regular contributor to Advocate Magazine, Huffington Post, Investopedia not to mention numerous TV appearances. He helps smart people across the USA get on track for their financial goals. For more information visit his website at www.davidraefp.com

You may also enjoy:

Dodd-Frank and New Fiduciary Rule ABC 7 Eyewitness News Video

[…] Today Show Video: Citi to Refund Millions – Jo Ling Kent with David Rae […]