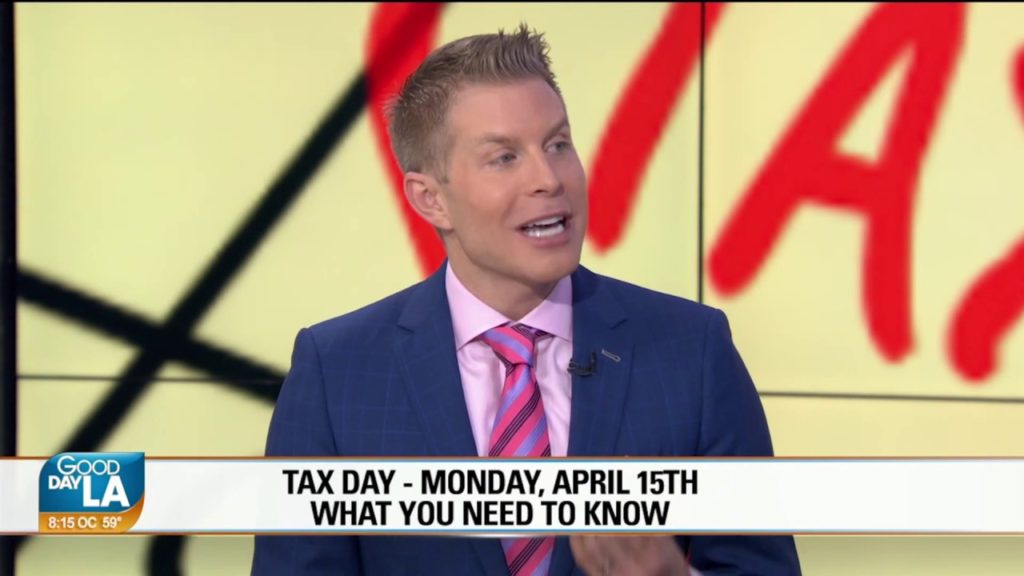

4 Valuable Tax Planning Strategies Gay Couples Need To Utilize For 2023 Tax Season.

By David Rae Certified Financial Planner™, Accredited Investment Fiduciary™

Two of my good friends just got gay married (or, as we call it in real life, “Married”), and of course, they asked me what this meant for their combined taxes as a gay couple. While I am a huge fan of marriage equality for all couples, I don’t love all the marriage penalties in our tax code. Many of these penalties are especially onerous for high-earning gay couples. It is good news that gay men are more likely to be college graduates, and gay couples make more than heterosexual couples and lesbian couples, on average.

Please don’t wait until 11:47 p.m. on your tax filing deadline each year to ask for a referral to an amazing tax expert. When you do, you put yourself at risk of getting shocked by a surprisingly high bill. This also increases your odds of missing out on tax planning strategies to lower your taxes owed, greatly increasing the odds of a mistake being made on your tax returns. Trust me, paying more taxes than you owe or racking up interest and penalties is nobody’s idea of a gay old time.

From my household to yours, here are a few things you should do now to be tax-wise this season and beyond. In my opinion, gay tax planning should not be an optional exercise; why pay the government more than is actually owed?

For Optimal Gay Tax Planning, Get on The Same Page Financially

Marriage equality has forced LGBTQ married couples to discuss finances at least once per year. You could call this a weird wedding gift from the IRS. Back when same-sex marriage was banned, I knew many couples who did not talk about money beyond how to split the shared bills like a mortgage or cable.

To pay the least amount of taxes over time, gay couples must function as a team. To do this, LGBTQ couples must talk about money, talk openly about money, and talk often about money. Talking about money and taxes may not be fun, but let me tell you, large tax bills are not fun either.

Filing taxes is stressful and a significant pain in the butt, regardless of your sexual orientation. But when it comes to tax liabilities for same-sex couples, ignorance is most definitely not bliss. Having the money talk or going on a financial date night is much better than a surprise tax bill come tax season. Get used to making smart gay tax planning moves throughout the year.

Schedule some time with your significant other to sit down uninterrupted and share your favorite cocktail or a nice bottle of wine (maybe two, depending on how serious this conversation may get). Discuss your short and long-term financial goals. Take a look at where you are financially today, both as individuals and as a couple. Perhaps you want to plan to retire early and fabulously.

As it is tax season, gather your tax documents and make an appointment with your wonderful CPA, or schedule a session to suffer through your own do-it-yourself TurboTax data entry. And if the dog did happen to eat some of your tax forms (I know, I know, it happens), the tax deadline for 2023 is October 16th (with extensions). Do what you need to do to get copies now. Hopefully, you are working with a fabulous gay financial planner who has helped you through the year with some proactive gay tax planning, so you won’t get any nasty surprises when filing your taxes.

The ‘Marriage Penalty’ Is Rough for Many Gay Couples

As a happily married gay man, I can tell you that the marriage penalty can be rough for high-earning LGBT couples. Much of the tax code is designed to benefit a nuclear family, where one spouse stays home and raises multiple children. Yes, I am aware many same-sex couples have children, but parenting is still less common in the gay community.

Gay Marriage Penalty Tax Brackets

Double incomes and no kids can be tax nightmares, especially for those who earn a salary. A single person would enter the highest federal tax bracket (37% in 2022) at an income of $539,000. In contrast, a married couple enters that tax bracket at $647,850 of income. Depending on how your income is split, most gay high-earning couples will pay more federal income taxes as married versus single.

Gay Marriage Penalty for Real Estate

Many real estate tax breaks are the same whether you are married or single. The mortgage deduction is $750,000, whether you are single or married. As a gay financial planner who resides in Los Angeles and Palm Springs, I’ll tell you this is a big deal for many of my clients who are gay couples.

The good news is there is no marriage penalty when you sell your home. You can exclude $250,000 of gains if you are single and $500,000 of gains as a married couple. With many gay couples living in expensive parts of town, this benefit can be a huge tax saver. Let’s be real; if you have owned a home for any number of years in most gayborhoods (Like Palm Springs) you have likely seen your home values skyrocket.

SALT CAP Marriage Penalty

One of the worst provisions for LGBT couples in the 2017 Tax Cuts and Jobs Act (TCJA) is the $10,000 state and local tax (SALT) cap. This cap is the same whether you are married or single. So essentially, a married couple will have half the SALT cap that two single people would have.

Now that you’re a married couple, some tax deductions may now make sense that didn’t work in the past. On the flip side, much of your income may end up in higher tax brackets when your income is combined. Your new higher combined income levels may also eliminate some tax deductions you were previously eligible for.

For high-income business owners in California, there are some workarounds to minimize the tax sting from the SALT Cap. Ask us about Pass-Through Entity tax strategies.

Read More: California Tax Planning: How To Avoid Overpaying Taxes Via A SALT CAP Strategy

Save For The Future Together

Do you dream of being financially independent? Is paying less in taxes appealing to you? Would you like to retire comfortably or, perhaps, retire early? If you answered yes to any (or all) of these questions, saving for retirement is a must. The money either of you contributes to a 401(k) or an IRA is excluded from your taxable income, helping you reduce your overall tax bill each year. Plan these contributions together. If one spouse makes substantially more than the other, it may make sense to help the lower-earning spouse contribute more to his or her retirement accounts. In some cases, one husband may contribute nearly 100% of his income to a retirement account. This is done to lower the overall household income.

I’m sure you’d rather write a check to yourself than the IRS. You have until tax time to fully fund an IRA or Roth IRA if you qualify for 2022. That can be another $6,000 deduction, each $12,000 for you as a couple, or $7,000/$14,000 for those gay couples who are 50 years of age or older. If one spouse does not work, gay couples can now also take advantage of a spousal IRA, further lowering their tax bills.

For those who are self-employed or business owners, you can still open and fund a SEP-IRA for 2022. This could allow contributions as large as $61,000, each, for 2022. Looking forward to 2023 and beyond, those making $280,000 or more should look at combining a 401(k) plan with a Cash Balance Pension Plan. This could allow you to shelter hundreds of thousands of dollars from taxation each year. The 401(k) contribution limit increases to $61,000 for 2022, and will hopefully be higher yet in 2023. Assuming you have enough self-employment income.

Give Your Investment Portfolio a Makeover

Want to improve your investment returns without having to take on any more investment risk? Look for tax savings within your portfolio. Ask your gay financial planner if there are any tax-saving opportunities in your nonretirement accounts. If that person is old school and doesn’t do tax-loss harvesting, it may be time to leave your stockbroker (probably calling themselves a “financial advisor) and start working with a fabulous financial planner. This fabulous financial planner should have the CFP® marks (Certified Financial Planner™),

Tax-loss harvesting can reduce your taxable income by $3,000, per year, or more if you are offsetting other realized short-term capital gains. Over the long term, it is estimated that proactive tax-loss harvesting can potentially add 1.75-2%, per year, (on average) to your net investment returns. Sprucing your returns can help make reaching your financial goals easier. Also, investing together may help reduce fees and costs associated with investing.

Get Tax Savings for Your Gay Philanthropy

Did you make a spring-cleaning donation to Out of Closet? You’ve done some good, and now, you may get a nice tax deduction as long as you received a receipt at the donation site. When donating cash, use a check or credit card to ensure you have easy proof of your generosity in case the IRS questions your contributions. You may be surprised how all those donations to the AIDS/LifeCycle and other charities add up. As they add up, they can mean substantial tax savings. Speaking of the AIDS/LifeCycle (7x rider here), you can also get a tax deduction for your expenses incurred volunteering or fundraising.

In a typical year, taxpayers would need to itemize to get a deduction for donations to charity. In 2020 and 2021, you can donate $300, each to charity and get a tax break even if you take the standard deduction.

A couple that files taxes together is married. Whether gay, straight, or otherwise, tax time is not sexy time. But making smart money moves and minimizing your tax liability could mean you get to take that next exotic vacation sooner.

Follow me on Twitter or LinkedIn. Check out my website or some of my other work here.

DAVID RAE, CFP®, AIF® is a Los Angeles retirement planner with DRM WEALTH MANAGEMENT. He has been helping friends of the LGBT community reach their financial goals for over a decade. He is a regular contributor to Forbes.com, the Advocate Magazine Investopedia and Huffington Post as well as the author of the Financial Planner Los Angeles Blog. Investopedia name David Rae one of the “100 Top Financial Advisors” in 2021 for the fifth year in a row. Follow him on Facebook, or via his website www.davidraefp.com

[…] More Tax Guidance: Gay Tax Planning Strategies You May Need Today […]

[…] Further Reading: Tax Planning For Gay Couples […]

[…] to a person who actually does comprehensive financial planning and tax planning as opposed to just selling investments or insurance […]

[…] of financial issues our straight counterparts didn’t have to deal with. Hopefully, most of those gay tax issues, financial issues, and estate tax nightmares are behind us. (If the political climate is anything […]